Jan. 31, 2025 - First published by the Canadian Tax Foundation in (2024) 72:4 Canadian Tax Journal. Treaty Provides Unique Benefits To Canadians Migrating To The United States Canadians who emigrate to the United States or elsewhere face many decisions and considerations...

Canada Confirms Intention to Institute New Interest and Deductibility Rules

Overview

The Department of Finance (Canada) (Finance) released draft legislation on February 4, 2022 that would limit the deduction of “interest and financing expenses” to a fixed percentage of earnings before interest, taxes, depreciation and amortization (EBITDA) for Canadian income tax purposes (EIFEL rules). Following a consultation period during which the department received more than 60 submissions, Finance confirmed (during the International Fiscal Association Canada Tax Conference held on May 17, 2022 [IFA Conference]) that it would be proceeding with the implementation of the proposed EIFEL (excessive interest and financing expenses limitation) rules in substantially the same form as initially proposed, with a few notable proposed changes that are being considered.

The EIFEL regime follows a comprehensive international effort to combat base erosion and profit shifting (BEPS). Specifically, the EIFEL rules stem from recommendations made by the Organisation for Economic Co-operation and Development (OECD) in its Action 4 report in October 2015 under the BEPS Action Plan. By implementing the EIFEL rules, Finance is seeking to prevent tax-planning techniques used by multinationals whereby favourable tax results are obtained by shifting taxable income from entities in high-tax jurisdictions to recipients that are not subject to tax or that are taxed at comparatively low tax rates or not at all.

The EIFEL rules will generally apply to taxation years beginning on or after January 1, 2023, with a fixed ratio of 40%, with that ratio decreasing to 30% (in line with the international norm) for taxation years beginning on or after January 1, 2024.

Key Takeaways

- The deductibility of net interest and financing expenses of corporations and trusts that are not excluded entities will be limited to “fixed ratio” of 30% of EBITDA for taxation years starting in or after 2024 (40% for taxation years starting in or after 2023).

- While this effectively is an anti-avoidance rule (even though not denominated as such), these restrictions may actually impact a significant number of Canadian taxpayers that would not have expected the rules to apply to them because their dealings have no underlying tax-avoidance motivation.

- Certain capital-intensive industries such as real estate and infrastructure will be disproportionally affected and the internal rate of return of their assets will be reduced. The international competitiveness of Canada will also be affected when compared with other countries such as the United States, whose legislation has an explicit exclusion for real estate and infrastructure.

- These rules seem to run directly contrary to the government’s stated objective to increase infrastructure spending, building more homes and making housing more affordable across the country.

- Taxpayers eligible for relief provided by a “group ratio” rule will have the incentive to model how both the fixed ratio and the group ratio would apply on a yearly basis, in order to determine which regime would provide the most beneficial treatment for any given year.

In-Scope Taxpayers

The EIFEL rules will apply to taxpayers that are corporations or trusts, while excluding natural persons and partnerships. However, the rules will apply to members of partnerships if those members are corporations or trusts, with the interest and financing expenses and revenues being attributed to them in proportion to their interest in the partnership.

While the rules are not meant to apply to purely domestic entities, the “excluded entity” exception is quite narrow and thus the threshold for application of the rules is low. In other words, a significant number of taxpayers will not qualify as excluded entities and therefore will be subject to the new restrictions on the deduction of interest and financing expenses, even though their activities are not motivated by tax avoidance.

“Excluded entities” include

- Canadian-controlled private corporations, and any associated corporations, with less than $15 million of taxable capital employed in Canada;

- taxpayers (corporations and trusts) resident in Canada with less than $250,000 of net interest and financing expenses in a taxation year; and

- taxpayers (corporations and trusts) resident in Canada if

- substantially all of the business of the taxpayer and its group is carried on in Canada;

- substantially all of its interest and financing expenses are payable to persons or partnerships that are not “tax-indifferent investors” (e.g., tax-exempt entities), which would generally include a lender owned by a pension plan or a Crown entity;

- no foreign affiliates are in the corporate group; and

- no non-resident owns more than 25% of the votes or fair market value of the taxpayer.

At the IFA Conference, Finance indicated it is contemplating increasing the threshold of taxable capital employed in Canada to $50 million, from $15 million, and increasing the threshold of net interest and financing expenses from $250,000. We note that the threshold of $250,000 is substantially lower than the threshold adopted by Germany and France (both €3 million) and the United Kingdom (£2 million).

Main Rule: The “Fixed Ratio”

The main rule of the EIFEL regime limits for a given taxpayer “the amount of net interest and financing expenses that may be deducted in computing a taxpayer’s income to no more than a fixed ratio of EBITDA.” No deduction is available in respect of any interest and financing expenses in excess of 30% (or, in 2023, 40%) of EBITDA. Note that the calculation of EBITDA under the EIFEL regime (i.e., for tax purposes) can differ from EBITDA as stated in a taxpayer’s financial statements.

The EIFEL rules allow taxpayers to carry forward excess capacity to deduct interest for three years and the restricted interest and financing expense for 20 years.

Alternative Rule: The “Group Ratio”

As an alternative to the fixed ratio, the EIFEL proposals contain a rule applicable to corporate groups that have audited consolidated financial statements, or that would be so required to have such statements if the entities were subject to International Financial Reporting Standards. If the requirements under the group ratio are met, the Canadian members of a group of corporations and/or trusts can jointly elect into the group ratio rules for a taxation year. This election is made on an annual basis and, thus, a corporation within a group could opt to benefit from the group ratio one year and choose to benefit from the fixed ratio in another year.

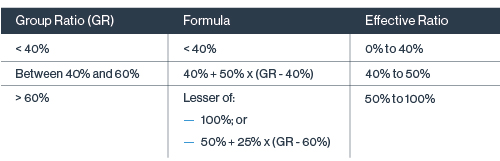

If the formula used to calculate the group ratio yields a ratio greater than the fixed ratio, the taxpayer can deduct interest and financing expenses in excess of the fixed ratio. The maximum interest and financing expenses the group members are collectively permitted to deduct is generally determined by the total of each member’s EBITDA, as calculated for tax purposes, multiplied by the group ratio. The group then allocates this amount among its members according to its group ratio election. The maximum effective ratio is calculated as follows:

We note that the “group net interest expense” is adjusted for amounts paid to, or received from, specified non-members (generally speaking, entities that are not members of the consolidated group but that do not deal at arm’s length with a group member, or entities that hold a significant interest in a group member or in which a group member holds a significant interest).

Our Insights

General

- The proposed EIFEL rules do not contain any avoidance or purpose test. In fact, the rules are purely mechanical in their application, subjecting all entities falling within the scope of the EIFEL rules to the regime. The complexity and formula-driven approach to the rules will necessarily increase compliance costs for taxpayers. Moreover, due to the wide-ranging applicability of the rules, a significant number of Canadian corporations and trusts that would not have expected to be subject to the rules would actually be caught.

- By implementing the EIFEL rules, Finance has decided to opt for a multi-layer approach to limiting interest deductibility, by using both the existing thin capitalization rules and the EIFEL rules. Neither during the consultation process nor at the IFA conference, has Finance indicated any intention that it would abandon the thin capitalization regime in favour of the proposed EIFEL regime.

- The availability of the fixed and group ratios will provide eligible entities with tax planning options. Taxpayers eligible for the group ratio will have the incentive to model how both the fixed ratio and the group ratio would apply on a yearly basis, in order to determine which regime would provide the most beneficial treatment for any given year.

Industry-Specific

- Certain capital-intensive industries such as real estate and infrastructure will be disproportionally affected and the internal rate of return of their assets will be reduced, inevitably rendering them less attractive and more costly. As a result, these rules seem to run directly contrary to the government’s stated objective of increasing infrastructure spending in key areas and making housing more affordable.

- Both the OECD and the United States have recognized that interest deductibility rules can adversely affect infrastructure and real estate, and have made explicit exceptions for those investments. If the EIFEL rules do not provide similar exemptions, investors in the sector will likely increase investment outside Canada and reduce investment in Canada. The proposed rules will hurt Canada’s international competitiveness in these industries.

- The rules do not apply to partnerships but will instead apply to the partners of the partnership on their share of the interest deductions. Investment funds should closely monitor the application of the rules to be able to properly answer information requests from investors. The application of the group ratio rules in respect of portfolio entities may also be affected.

- The competitiveness of the lending business of tax-exempt entities (which would generally include a lender owned by a pension plan or Crown entity) or of debt funds with non-resident or tax-exempt investors will be affected because dealing with these entities will likely subject the borrower to the application of the EIFEL rules. This is particularly relevant in the mining or venture capital space.

We will continue to monitor any developments regarding the EIFEL proposals for future updates to communicate.

Key Contacts

Expertise

Related

Federal Court of Appeal Confirms CRA Can Collect Arrears Interest Despite Absence of a Tax Debt

Dec. 04, 2024 - The Federal Court of Appeal (FCA) recently dismissed the Bank of Nova Scotia’s (BNS) appeal and upheld the Canada Revenue Agency’s (CRA) practice of charging arrears interest on a non-existent tax debt where audit adjustments increase taxable income that is offset by the carryback of a loss...