Jan. 31, 2025 - First published by the Canadian Tax Foundation in (2024) 72:4 Canadian Tax Journal. Treaty Provides Unique Benefits To Canadians Migrating To The United States Canadians who emigrate to the United States or elsewhere face many decisions and considerations...

Canada Emergency Wage Subsidy: An Updated Guide for Businesses

The federal government passed legislation on July 27, 2020, extending the Canada Emergency Wage Subsidy (CEWS) and significantly broadening its reach. In this guide, we provide a comprehensive review and analysis of the CEWS program, including details of the latest updates and key considerations for businesses.

Contents

- Background

- Qualifying for the CEWS

- Determining the Amount of the Subsidy

- Tax Treatment of the Subsidy

- Anti-Abuse Rules

- Applying for the Subsidy

- Appeals of Subsidy Determinations

Background

Earlier this year, Parliament enacted legislation adopting the Canada Emergency Wage Subsidy (CEWS) through amendments to the Income Tax Act (Canada) (Act). Although the CEWS program is not tax legislation per se, by implementing the CEWS through the Act, the government sought to leverage existing income tax refund mechanisms to distribute the subsidy to employers in a timely manner and to utilize the broad investigative powers and penalty provisions of the Act to verify and encourage compliance with the terms of the program.

The federal government initially announced that the CEWS would be in place for a 12-week period running from March 15 to June 6, 2020. In a press release issued on May 15, 2020, the government announced that the CEWS would be extended for an additional 12 weeks – to August 29, 2020. The government also announced that eligibility for the CEWS would be expanded to include a number of employer entities that may have otherwise been unable to access the program due to earlier (presumably inadvertent) exclusions in the initial amendments to the Act.

We have previously reviewed the initial legislation and the May 15 press release in detail. See our earlier analysis of the Initial Legislation and the May 15 Press Release and Relevant CRA Guidance.

On July 27, 2020, further legislation was enacted extending the CEWS to November 21, 2020, with the ability to further extend it to no later than December 31, 2020 by regulation, and giving effect to the legislative proposals announced in the government’s May 15 press release. Significant amendments to the program also apply for the qualifying periods beginning on or after July 5, 2020.

Despite these amendments, the existing CEWS program remains largely unchanged for qualifying periods ending prior to July 5, 2020. To qualify for the CEWS for such periods, an eligible employer must have experienced a decline in qualifying revenue of at least 30% when measured against certain revenue benchmarks. The amount of the subsidy received by a qualifying employer for these periods is generally equal to 75% of the eligible remuneration paid to eligible employees, subject to a weekly maximum subsidy of $847 per employee and special rules that apply to non-arm’s length employees.

Under the revised CEWS program, applicable to qualifying periods beginning on or after August 30, 2020, the 75% subsidy will be replaced by a base amount of subsidy, plus a top-up amount that is generally available only to those employers that have been the most adversely affected by the COVID-19 pandemic. For periods beginning on July 5 and August 2, 2020, the subsidy is the greater of the amounts computed under the old rules and these new rules. A second significant change permits all eligible employers that have experienced a decline in their qualifying revenue to receive a base amount of subsidy regardless of the amount of such revenue decline. The base amount and top-up amount of the subsidy (where applicable) are scaled up as an employer’s decline in qualifying revenue increases, and each of these amounts is subject to a percentage-based cap. Finally, the most recent legislative amendments provide for the CEWS to be slowly phased out over the remaining term of the program, so that the maximum subsidy available will decrease over time.

In all, the CEWS now provides relief to a greater number of employers, by eliminating the qualifying revenue “cliff” that existed under the original program. This expanded coverage is at the expense of a potential reduction in the amount of the subsidy (compared with previous levels) available to employers, and a significant increase in complexity.

Qualifying for the CEWS

In order for an employer to qualify for the CEWS, it must first be an “eligible entity.” There have been some minor, but notable, changes to the definition, which were first announced in the government’s May 15 press release. Partnerships with non-eligible members were initially not eligible entities, but are now eligible provided that at least 50% of the partnership is owned by eligible entities. Tax-exempt trusts that are not otherwise eligible (as a registered charity, for example) are no longer eligible for qualifying periods starting on or after May 10, 2020. Certain tax-exempt entities, including qualifying Indigenous government–owned entities, have also been added to the list of eligible entities.

Any of the following types of employers can currently qualify as an eligible entity:

- a corporation or trust that is not exempt from Part I tax or is a public institution;

- an individual other than a trust;

- a registered charity, other than a public institution;

- certain non-profit organizations, other than public institutions;

- a partnership that is 50% or greater owned by eligible entities;

- certain Indigenous government–owned corporations and partnerships;

- registered Canadian amateur athletic associations;

- registered journalism organizations;

- non-public educational and training institutions; and

- any other organization prescribed by the government.

The scope of eligible entities is quite broad, encompassing most forms of taxable business organizations and several tax-exempt organizations. The main exclusions from eligible entity status apply to the aforementioned tax-exempt trusts and public institutions, including local governments, Crown corporations, schools, school boards, hospitals, health authorities, and public universities and colleges. However, private schools and private colleges (including arts schools, language schools, driving schools, flight schools and culinary schools) have been prescribed as eligible entities and thus can qualify for the CEWS.

It is important to note that CEWS eligibility is determined at the entity level, rather than at the level of the employer’s business. As a result, taxpayers that have structured their businesses as multiple divisions within a single entity may be treated differently under the program from those that have formed separate entities for each business. In particular, where several businesses are carried on in a single entity, the financial results for these businesses must be aggregated for the purpose of determining whether the entity qualifies for the CEWS, meaning that a business that might qualify for the wage subsidy if it were carried on in a separate entity may not qualify if it is one of a number of divisions within a single entity. Unlike the consolidation and “de-consolidation” options available to businesses carried on in separate entities, a division within a particular entity cannot determine its CEWS eligibility on a stand-alone basis.

The CEWS program has been extended at least until November 21, 2020. Thus, wage subsidies under the program are available for the following nine “qualifying periods” of four weeks each:

- March 15, 2020–April 11, 2020

- April 12, 2020–May 9, 2020

- May 10, 2020–June 6, 2020

- June 7, 2020–July 4, 2020

- July 5, 2020–August 1, 2020

- August 2, 2020–August 29, 2020

- August 30, 2020–September 26, 2020

- September 27, 2020–October 24, 2020

- October 25, 2020–November 21, 2020

The CEWS may be extended further by regulation to no later than December 31, 2020.

An employer’s eligibility for the CEWS is determined for each qualifying period, except that an employer that qualifies for the CEWS in a particular qualifying period will automatically qualify in the immediately following qualifying period. For example, if an eligible employer qualified for the CEWS during the March 15–April 11, 2020 qualifying period, it would have automatically qualified for the April 12–May 9, 2020 qualifying period. As discussed below, an eligible employer must submit an application for each qualifying period in which it wishes to obtain a subsidy, even if it automatically qualifies for a subsidy in that period.

For the qualifying periods beginning July 5, 2020, and onward, the 30% revenue decline qualification threshold has been removed and replaced with a “revenue reduction percentage,” which determines the extent of an eligible employer’s entitlement to a wage subsidy. For these periods, an eligible employer’s revenue reduction percentage is deemed to be no less than its revenue reduction percentage in the immediately preceding period. As discussed below, this is relevant to determining the base amount of subsidy the employer is entitled to, but not the top-up amount.

Current Reference Period and Prior Reference Period

To determine whether an eligible employer qualifies for the CEWS, its “qualifying revenue” for the “current reference period” is compared to its qualifying revenue for the “prior reference period.” For the qualifying periods ending prior to July 5, 2020, an employer’s qualifying revenue during the current reference period must have decreased by at least 15% in March 2020 for the qualifying period running from March 15–April 11, 2020 and by at least 30% for the three subsequent qualifying periods (subject to automatic qualification, as discussed above).

Under the revised CEWS program, which applies to the qualifying periods beginning on July 5, 2020 and onward, any eligible employer that has experienced a decline in its qualifying revenue is eligible for some amount of base subsidy. As calculated for the first four qualifying periods, the amount of base subsidy an employer is entitled to is determined by comparing its qualifying revenue for the current reference period with its qualifying revenue for the prior reference period. However, as discussed below, the applicable reference periods are slightly different for purposes of determining an employer’s eligibility for a top-up amount of subsidy.

Current Reference Period

For each qualifying period starting on or before August 2, 2020, the current reference period is the calendar month in which the qualifying period commences. For example, August 2020 is the current reference period for the August 2–August 29, 2020 qualifying period. The current reference period for each subsequent qualifying period is as follows:

Prior Reference Period

An eligible employer can select one of two methods for determining the prior reference period, depending on which method is most favourable in its particular circumstances. However, once an employer has selected a method for determining the prior reference period, it must use that method for each qualifying period ending prior to July 5, 2020.

The most recent legislative amendments permit an eligible employer to reconsider its choice of prior reference period for the qualifying periods starting on or after July 5, 2020. In other words, for these qualifying periods, an eligible employer can choose to use either the default method or the alternative method for determining the prior reference period regardless of which method it used for the first four qualifying periods. However, whichever method is selected for the July 5–August 1, 2020 qualifying period must be used for each subsequent qualifying period.

Default Prior Reference Period

The default prior reference period is the 2019 calendar month corresponding to the current reference period. Accordingly, an eligible employer using this method would compare its qualifying revenue for July 2020 with its qualifying revenue for July 2019 to determine whether it is eligible for the CEWS during the July 5, 2020–August 1, 2020 qualifying period. It would then compare its August 2020 qualifying revenue with its August 2019 qualifying revenue for the following qualifying period, and so on. An eligible employer will automatically be required to use this default method unless it elects to use the alternative method described below in its CEWS application.

Alternative Prior Reference Period

Under the alternative method, the prior reference period is January and February 2020 and the employer’s qualifying revenue for that period is equal to its average monthly qualifying revenue during those two months. The prior reference period is prorated to the extent that the employer did not carry on business throughout the entirety of January and February 2020. The alternative method is intended to provide relief for new employers that may not have carried on business during the relevant part of the 2019 calendar year or whose operations have scaled up significantly during the past 12 months, though it is not limited to such employers. The proration mechanism also serves to provide a benchmark for startups whose operations commenced during January or February 2020.

Reduction in Qualifying Revenue

To qualify for the wage subsidy for the qualifying periods ending prior to July 5, 2020, an eligible employer’s qualifying revenue for the current reference period cannot exceed the “specified percentage” of its qualifying revenue for the prior reference period.

The specified percentage in respect of the March 15–April 11, 2020 qualifying period is 85%, and the specified percentage in respect of the next three qualifying periods is 70%. Thus, to qualify for the CEWS in respect of the March 15–April 11, 2020 qualifying period, an eligible employer’s March 2020 qualifying revenue must have declined by at least 15% relative to the prior reference period. For each subsequent qualifying period ending prior to July 5, 2020, the requisite revenue decline increased to 30%. The lower 15% figure was used for the initial qualifying period because the COVID-19 pandemic was not declared until March 15, 2020, and thus many Canadian businesses may have started to feel the impact of the pandemic during the second half of March 2020.

For the qualifying periods starting on or after July 5, 2020, any eligible employer whose qualifying revenue for the current reference period is less than its qualifying revenue for the prior reference period is eligible for a base amount of subsidy. The amount of such decline, expressed as a percentage, is referred to as the eligible employer’s “revenue reduction percentage” and is relevant to the computation of the base subsidy it is entitled to for a particular qualifying period, as discussed below.

To qualify for the additional top-up amount of subsidy, an eligible employer’s “top-up revenue reduction percentage,” which is discussed in greater detail below, must exceed 50%.

Qualifying Revenue

An eligible employer’s “qualifying revenue” includes the inflows of cash, receivables or other consideration arising in the course of its ordinary activities in Canada in the particular period. However, it excludes the following receipts:

- extraordinary items;

- amounts received from non-arm’s length persons;

- amounts received under the CEWS or the 10% Temporary Wage Subsidy; and

- for registered charities and non-profit organizations, funding from government sources (if the charity or organization so elects).

In general, an eligible employer’s qualifying revenue is determined in accordance with its usual accounting practices. However, as discussed below, some flexibility has been provided for closely held groups and entities that earn all or substantially all their revenue from non-arm’s-length sources. In addition, any eligible employer can elect to determine its revenue using the cash or accrual methods of accounting, though such an election must be made for all qualifying periods.

Accordingly, an eligible employer may wish to take a long-term view of its business in selecting the appropriate accounting method by which to determine its qualifying revenue. For example, employers whose receivables carry high default risk or whose major customers have been particularly hard hit by the pandemic may wish to consider using the cash method of accounting to ensure that they receive timely recognition of doubtful accounts and/or bad debts for CEWS purposes.

Amalgamations and Wind-Ups

The most recent amendments to the CEWS included a relieving rule applicable to amalgamations and wind-ups of subsidiaries, which was previously announced in the government’s May 15 press release. This relieving rule deems an amalgamated corporation to be the same corporation as, and a continuation of, each predecessor corporation. Thus, a corporation formed by amalgamation, or a corporation into which another has been wound up, can aggregate the qualifying revenues of its predecessor corporations in determining its qualifying revenue. Absent this rule, an amalgamated corporation could have been required to determine its CEWS eligibility by comparing the qualifying revenue of the recently combined business of the amalgamated corporation with the qualifying revenue of a single predecessor corporation.

This provision is supplemented by an anti-avoidance rule that applies where it is reasonable to consider that one of the main purposes for the amalgamation or winding-up was to qualify for the CEWS or to increase the amount of a subsidy received under the program. Presumably, amalgamations and wind-ups undertaken prior to the announcement of the CEWS or that were undertaken for bona fide business purposes would not be affected by this anti-avoidance rule.

As promised in the government’s May 15 press release, this provision was enacted with retroactive effect to April 11, 2020. Thus, corporations that qualify for the CEWS by virtue of this relieving rule should be entitled to receive a subsidy for each qualifying period in which they meet the applicable requirements.

Asset Purchase Transactions

The most recent legislative amendments have also filled in a gap that previously existed in the program with respect to asset purchase transactions. Since qualifying revenue is computed at the entity level, the acquisition of a business by an eligible employer could materially affect its qualifying revenue for a period.

Under the new amendments, an eligible employer that purchased Canadian business assets in or before a qualifying period can elect to include in computing its qualifying revenue for the prior reference period or the current reference period, as the case may be, the qualifying revenue of the seller that is reasonably attributable to such assets. The acquired assets must have been used by the seller in the course of a business carried on in Canada by it and, immediately before the acquisition, the fair market value of the acquired assets must have constituted all or substantially all of the fair market value of the property of the seller used in the course of carrying on the business.

In order to access this relieving provision, the purchaser and the seller (if it is still in existence) must make a joint election to assign the qualifying revenue reasonably attributable to the acquired assets from the seller to the purchaser. As a result, the seller’s qualifying revenue for any applicable reference period will be reduced by the amount of any qualifying revenue assigned to the purchaser.

If any portion of the assigned revenue is earned from a person that did not deal at arm’s length with the seller, and that person deals at arm’s length with the purchaser, that revenue is deemed not to have been earned from such non-arm’s length person. This deeming rule accommodates the fact that, had the purchaser earned the assigned qualifying revenue directly, this revenue would have been earned from arm’s length persons.

As with the relieving rule applicable to amalgamations and wind-ups, this provision contains an anti-avoidance rule that applies where it is reasonable to conclude that one of the main purposes of the acquisition was to increase the amount of a subsidy the purchaser was entitled to under the CEWS. Again, it is expected that acquisitions undertaken prior to the announcement of the CEWS or those undertaken for bona fide business purposes would not be affected by this anti-avoidance rule.

Special Rules for Closely Held Groups

Eligible entities within a closely held group are provided with additional flexibility in calculating their qualifying revenue under the CEWS.

Consolidation and “De-consolidation”

Eligible entities within a group that normally prepares its financial statements on a consolidated basis may determine their qualifying revenue separately. However, this option is available only if every member of the group determines its qualifying revenue on this basis. No election is required to effect this decision to “de-consolidate.”

Conversely, an affiliated group of eligible entities (i.e., generally, entities under common control) can jointly elect to determine the qualifying revenue of the group on a consolidated basis in accordance with relevant accounting principles. Thus, each eligible entity within the group would qualify for the CEWS if the group as a whole qualifies. Similarly, for the qualifying periods starting on or after July 5, 2020, the entitlement of each eligible entity within the group to a base subsidy and a top-up amount would be determined on the basis of the qualifying revenue of the group as a whole.

Group consolidation is available only if every member of the affiliated group makes the joint election. The CRA has stated in its administrative guidance that the consolidation election must be made by the broadest affiliated group of eligible entities possible and not a subset of that group. Thus, a smaller affiliated group cannot elect to consolidate to the exclusion of other members within the larger affiliated group. However, as we have previously noted, only the Canadian revenue of the affiliated group is counted, and thus revenue fluctuations among foreign affiliates within a corporate group generally are not considered for CEWS purposes.

The CRA has also confirmed in its administrative guidance that a prior decision to make the consolidation election for a qualifying period is not binding on subsequent qualifying periods. Consequently, an affiliated group can determine for each qualifying period whether to report its revenues on a consolidated basis or individually and elect accordingly. This election optionality may provide affiliated groups with the flexibility to select the optimal revenue computation method for their particular circumstances.

Employers Earning Revenue from Non-Arm’s Length Sources

A specific relieving rule applies to employers that earn all or substantially all (generally, 90% or more) their revenue from non-arm’s length sources. This rule is a corollary to the exclusion of revenue from non-arm’s length sources from the definition of qualifying revenue, because eligible employers that earn significant non-arm’s length revenue may fail to show the necessary decline in qualifying revenue regardless of the actual revenue decline suffered.

To access this relieving rule, an eligible employer must earn all or substantially all its qualifying revenue (determined without reference to the non-arm’s length revenue exclusion) from non-arm’s-length persons and each such person must make a joint election with the eligible entity. Where these requirements are met, the employer’s qualification for the CEWS, and the amount of the subsidy it is entitled to, will be determined on the basis of the reduction in qualifying revenue experienced by the particular non-arm’s length persons from whom it earns revenue. Where the employer earns revenue from more than one non-arm’s length person, its reduction in qualifying revenue is determined by the weighted-average reduction experienced by each such person.

Notably, in determining the qualifying revenue of a particular non-arm’s-length person for these purposes, such qualifying revenue need not arise from activities in Canada. Thus, an eligible employer that earns all or substantially all its revenue from non-arm’s-length non-residents should be able to access the CEWS on the basis of a revenue reduction in respect of their foreign-based activities.

Determining the Amount of the Subsidy

Generally, for qualifying periods ending prior to July 5, 2020, the CEWS is intended to provide a subsidy equal to 75% of the eligible remuneration (i.e., normal salary, wages and other qualifying remuneration) paid to eligible employees, up to $847 per week, per employee. Special rules apply for non-arm’s length employees.

Effective July 5, 2020, the subsidy available to eligible employers comprises two components:

- a base amount of subsidy available to all eligible employers that have experienced a decline in qualifying revenue, with the amount of the base subsidy varying according to the scale of revenue decline; and

- a top-up amount of up to an additional 25% for the most adversely impacted employers.

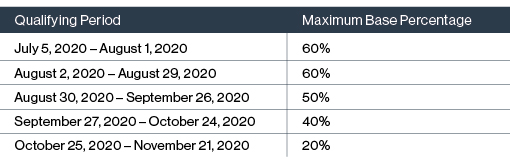

For the qualifying periods starting on July 5, 2020, and August 2, 2020, an eligible employer is entitled to the greater of the amount available under the old rules (i.e., for arm’s-length employees, 75% of eligible remuneration up to $847 per week per employee, provided that the employer experiences a revenue reduction of at least 30%) and the amount available under the new rules. Under the new rules, the maximum base amount of subsidy is equal to 60% of the eligible remuneration paid to eligible employees for these two qualifying periods. As illustrated below, this maximum base amount of subsidy gradually declines to 20% over the remaining term of the program.

Taking into account the top-up, the computations necessary to determine the amount of an eligible employer’s subsidy entitlement are more involved than under the old rules. Generally, eligible employers that do not qualify for the full top-up amount will receive a smaller subsidy under the new rules than they would have received under the old rules, starting in the period that begins August 30, 2020.

An employer can only obtain the CEWS in respect of eligible remuneration paid to “eligible employees,” being individuals employed in Canada by the eligible employer in that qualifying period. In addition, for the qualifying periods ending prior to July 5, 2020, they also must not have been without remuneration for 14 or more consecutive days during that period. This condition does not apply for the qualifying periods starting on or after July 5, 2020, and thus an eligible employer may be entitled to a subsidy for these periods in respect of remuneration paid to employees who were on leave without pay for more than 14 consecutive days or who were hired in the later stages of the period.

The requirement that an eligible employee be employed by the entity claiming the subsidy precludes an eligible entity from claiming the wage subsidy in respect of individuals employed by an entity in the larger corporate group to which services fees are paid by the eligible entity for the use of its employees. “Head office” structures might, therefore, be unable to access the CEWS in respect of the head office employees unless they meet the test described above under “Employers Earning Revenue from Non-Arm’s Length Sources.” Note, however, that this caveat applies only in the context of the CEWS and may not apply for purposes of federal or provincial employment standards or other laws.

Eligible Remuneration and Baseline Remuneration

An eligible employer’s subsidy entitlement for a particular week in a qualifying period is determined on the basis of the “eligible remuneration” paid to an eligible employee in respect of that week or, in certain circumstances, the employee’s “baseline remuneration.”

For remuneration paid to arm’s-length employees for the qualifying periods ending prior to July 5, 2020, the amount of the subsidy is equal to 75% of the greater of the eligible remuneration paid to them in respect of the week and their baseline remuneration, up to a maximum subsidy of $847. In the case of remuneration paid to non-arm’s-length employees during these periods, the amount of the subsidy is equal to the lesser of the amount of the eligible remuneration paid to them in respect of the week and their baseline remuneration, up to the $847 weekly cap. Thus, under the old rules, there was a “floor” for arm’s-length employees equal to 75% of their baseline remuneration (since the subsidy covered 100% of the employee’s wages up to this amount), and the subsidy covered 75% of any increase in arm’s length employees’ eligible remuneration above their baseline remuneration, subject to the cap of $847 per week and anti-avoidance rules for artificial increases. These enhancements were not available for non-arm’s-length employees, such as where the eligible employer is controlled by the employee or a relative of the employee.

Under the new rules, the 75% subsidy rate has been replaced by a combined percentage representing the eligible employer’s base amount of subsidy plus the top-up amount (if any). In addition, the baseline remuneration figure is no longer relevant for arm’s length employees under the amended program (unless they have been temporarily laid-off with pay, as discussed below). For these arm’s length employees, the amount of the subsidy is simply a percentage of the eligible remuneration paid to the employee for the particular week, up to a maximum remuneration figure of $1,129. Thus, while remuneration increases for arm’s length employees may be subsidized, as before, the “floor” available under the old rules has been eliminated, meaning that a reduction in remuneration for arm’s length employees can no longer result in a greater proportion of their wages being subsidized.

For non-arm’s length employees, the subsidy under the new rules is equal to a percentage of the lesser of the employee’s baseline remuneration and the eligible remuneration paid to them in respect of the week. Thus, as before, an increase in the remuneration for a non-arm’s length employee would not be eligible for the subsidy.

Eligible Remuneration

An employee’s eligible remuneration includes normal salary, wages and other qualifying remuneration (such as fees and commissions). However, retiring allowances, stock option benefits and amounts that can be expected to be repaid are excluded. Amounts may also be excluded in certain circumstances in which the employee’s remuneration is increased in order to artificially increase the amount of the wage subsidy available to the employer.

Baseline Remuneration

Under the initial CEWS legislation, an employee’s baseline remuneration was equal to the average weekly eligible remuneration paid to them from January 1, 2020, to March 15, 2020, excluding any period of seven or more consecutive days for which the employee was without remuneration. As a result, many employers could have received lower than intended subsidies in respect of seasonal employees or employees who were on unpaid leave during this time. The government announced in its May 15 press release that it would address this issue by permitting employers to select one of two methods for determining an employee’s baseline remuneration. This accommodation was provided in the most recent legislative amendments, with retroactive effect to the first qualifying period, by permitting employers to determine an employee’s baseline remuneration using either the January 1–March 15, 2020 period or, alternatively:

- for the qualifying periods ending prior to June 7, 2020, the period beginning March 1, 2019, and ending May 31, 2019;

- for the June 7, 2020–July 4, 2020 qualifying period, the period beginning March 1, 2019, and ending June 30, 2019, or the period beginning March 1, 2019, and ending May 31, 2019; and

- for the qualifying periods beginning on or after July 5, 2020, the period beginning July 1, 2019, and ending December 31, 2019.

In all cases, any period of seven or more consecutive days that the employee was without remuneration is excluded from the calculation.

As this amendment is retroactive to the first qualifying period, an eligible employer should be permitted to use the most favourable baseline remuneration period to determine its CEWS entitlement for all qualifying periods. It will generally be favourable for an employer to select the period that results in the highest baseline remuneration figure, particularly in the case of non-arm’s length employees and arm’s length employees whose remuneration was reduced in any of the first four qualifying periods. The choice of period can be made on an employee-by-employee basis in respect of both arm’s length and non-arm’s length employees.

For qualifying periods starting on or after July 5, 2020, an eligible employer is entitled to a base amount of subsidy equal to its “base percentage” for the qualifying period. The base percentage is determined by multiplying the employer’s revenue reduction percentage by the applicable multiple for the qualifying period. As discussed above, an eligible employer’s revenue reduction percentage is the amount, expressed as a percentage, by which its qualifying revenue declined in the current reference period relative to the prior reference period. The applicable multiples for each qualifying period are as follows, illustrating the gradual phasing out of the CEWS over the remaining term of the program:

Thus, for example, if an eligible employer’s qualifying revenue has declined by 25% in July 2020 compared with the prior reference period it selected, its revenue reduction percentage would be 25% for the July 5–August 1, 2020 qualifying period. This percentage would then be multiplied by 1.2 to result in a base percentage of 30% for that period. As noted above, for the qualifying periods starting on July 5 and August 2, 2020, an eligible employer is entitled to a subsidy equal to the greater of the amount computed under these new rules and under the old rules. In this case, since the eligible employer’s actual revenue decline (i.e., excluding the multiple calculation) is less than 30%, it would not be entitled to the 75% subsidy provided under the old rules.

An eligible employer’s base percentage (and thus the amount of its base subsidy) is also subject to a maximum percentage that applies if its revenue reduction percentage is equal to or greater than 50%. These percentages are as follows for each qualifying period:

As noted above, if an eligible employer qualified for the CEWS in a particular qualifying period, its revenue reduction percentage for the immediately following qualifying period is deemed to be no less than its revenue reduction percentage for that preceding qualifying period. In other words, if an eligible employer experienced a 50% revenue decline in June 2020 and a 30% revenue decline in July 2020, its base amount of subsidy in respect of the July 5–August 1, 2020 qualifying period would be determined as if it had experienced a 50% revenue decline in July 2020. This change adapts the old “automatic qualification” rule to reflect the new scaled approach to the CEWS whereby an employer’s subsidy entitlement is reduced as its qualifying revenues start to rebound. Conversely, if an eligible employer experiences a greater revenue decline in an immediately subsequent qualifying period, its base amount of subsidy is determined using its actual revenue reduction percentage for that period.

It should be noted, however, that an eligible employer’s base amount of subsidy may still decrease in a subsequent qualifying period, despite it being deemed to have experienced the same revenue decline in that period, due to the gradual phasing out of the subsidy. For instance, a revenue reduction percentage of 50% for the August 2–August 29, 2020 qualifying period would result in a base percentage of 60%. That same 50% revenue reduction percentage would give rise only to a base percentage of 50% for the August 30–September 26, 2020 qualifying period.

Top-Up Revenue Reduction Percentage

In addition to the base amount of subsidy, an eligible employer may be entitled to a top-up amount for any qualifying period beginning on or after July 5, 2020. The first step in determining an employer’s entitlement to a top-up, and the amount of such top-up, is to calculate its top-up revenue reduction percentage. This top-up revenue percentage is determined by comparing the eligible employer’s monthly average qualifying revenue during the three calendar months immediately preceding the current reference period with one of the following amounts:

- if the prior reference period is January and February 2020, the eligible employer’s monthly average qualifying revenue during this period; or

- if the default prior reference period is used, the eligible employer’s monthly average qualifying revenue during the three calendar months immediately preceding the prior reference period.

For example, if the qualifying period is July 5–August 1, 2020 and the default prior reference period is used (i.e., July 2019), the eligible employer’s top-up revenue reduction percentage would be determined by comparing its monthly average qualifying revenue from April to June 2020 with its monthly average qualifying revenue from April to June 2019. If the eligible employer has instead elected to use the alternative prior reference period, its monthly average qualifying revenue from April to June 2020 would be compared with its monthly average qualifying revenue in January and February 2020.

The top-up revenue reduction percentage is the amount, expressed as a percentage, by which the eligible employer’s average qualifying revenue declined in the current three-month period relative to the corresponding three-month period in 2019 or, if it so elected, its average qualifying revenue from January and February 2020. As illustrated below, an eligible employer will be entitled to a top-up amount of subsidy only where its top-up revenue reduction percentage exceeds 50%, and it will reach the maximum top-up amount of 25% where its top-up revenue reduction percentage is 70% or greater. Unlike the base amount of subsidy, the top-up subsidy amount does not decline over the remaining term of the program.

Calculating the Top-Up Amount

An eligible employer is entitled to a top-up amount of subsidy equal to its “top-up percentage” for the particular qualifying period. This top-up percentage is determined by multiplying the amount by which the eligible employer’s top-up revenue reduction percentage exceeds 50% by 1.25. For example, if an eligible employer’s top-up revenue reduction percentage is 60%, its top-up percentage would be equal to 10% multiplied by 1.25, or 12.5%. The top-up percentages for various given top-up revenue reduction percentages are set out below:

Added Complexity Under the New Subsidy Computation Rules

As readers who have made it this far are no doubt aware, the computation of an eligible employer’s subsidy entitlement under the CEWS has been made significantly more complex for the qualifying periods starting on or after July 5, 2020. A great deal of this complexity arises from the separate measurement periods used to determine the base amount of subsidy and the top-up amount. New, separate rules applicable employees who have been temporarily laid-off with pay (discussed below) add further complexity to the program.

The base amount of subsidy is computed using an eligible employer’s revenue reduction percentage, which is determined by comparing the employer’s qualifying revenues in the current reference period with its qualifying revenues in the prior reference period. This calculation was already required to determine whether the 30% revenue reduction threshold under the existing CEWS program had been met. The declining value of the subsidy over time is a function of the multiple applied to the percentage to determine the base percentage: the multiple starts at 1.2 and drops to 0.4 for the qualifying period starting on October 5, 2020. Finally, a maximum to the base percentage is imposed by effectively ignoring any revenue reduction greater than 50%. So, the maximum base percentage for the period starting on July 5 is 60% (50% x 1.2), and the maximum base percentage for the period starting on October 5 will be 20% (50% x 0.4).

The top-up subsidy, on the other hand, is computed using an eligible employer’s top-up revenue reduction percentage, which looks to the average reduction for the preceding three periods. This requires a comparison between the employer’s qualifying revenues in the three months prior to the current reference period and its qualifying revenues either (i) in the three months prior to the prior reference period (if the default prior reference period is used) or (ii) in the prior reference period (if the election is made to use January and February 2020 as the prior reference period). Unlike the base percentage, the maximum top-up percentage does not decline over time; it is capped at 25%, which effectively means that an average reduction in excess of 70% is ignored for purposes of the computations.

The intent of the top-up subsidy is clearly to provide targeted assistance to those businesses that have been the most adversely affected by the COVID-19 pandemic. It remains to be seen whether the additional layer of complexity, and the accompanying administrative burden, will dampen the intended effect.

Under the existing CEWS program, applicable to the qualifying periods ending prior to July 5, 2020, no distinction was made between remuneration paid to eligible employees who are reporting to work and those who are on paid leave (e.g., a paid temporary layoff).

However, for the qualifying periods beginning on or after July 5, 2020, an eligible employer will be required to determine its subsidy entitlement in respect of employees who have been temporarily laid off with pay (including pay at a rate lower than their pre-layoff pay rate) under a new set of rules.

For the qualifying periods starting on July 5, August 2 and August 30, an eligible employer that experienced a decline in its qualifying revenue will be entitled to the subsidy it would have otherwise received under the existing CEWS program in respect of temporarily laid-off employees. Notably, however, the employer does not need to experience a revenue decline of 30% or more to receive this subsidy. Any revenue reduction percentage or top-up percentage greater than zero is sufficient for these purposes.

For the qualifying periods beginning on or after September 27, 2020, the treatment of temporarily laid-off employees changes yet again. An eligible employer whose revenue reduction percentage or top-up percentage is greater than zero will continue to qualify for a subsidy in respect of its temporarily laid-off employees. However, the amount of the subsidy in respect of arm’s length temporarily laid-off employees will be equal to the lesser of the amount of eligible remuneration paid to the employee and the amount prescribed by regulation. For non-arm’s-length employees, no subsidy is available unless the employee’s baseline remuneration is greater than zero.

The government has not yet announced the amount to be prescribed for these purposes, but it has stated that it intends to adjust the amount of the subsidy an employer is entitled to in respect of temporarily laid-off employees to align it with the benefits provided through the Canada Emergency Response Benefit and/or Employment Insurance. The stated purpose of this proposed measure is to ensure equitable treatment of employees on furlough between both programs and to transition employees more easily back to the workforce so they may be reconnected with their employers.

Other Amounts That Increase or Reduce the Subsidy

The subsidy received by an eligible employer under the CEWS is reduced by any benefit it received under the now defunct 10% Temporary Wage Subsidy program and any work-sharing benefits received by an eligible employee under the Employment Insurance Act.

On the other hand, the amount of an eligible employer’s subsidy under the program is increased by amounts payable by it as employer premiums or contributions under the Employment Insurance Act, the Canada Pension Plan (or, as applicable, the Act respecting the Québec Pension Plan) and Québec’s Parental Insurance Plan in respect of temporarily laid-off employees.

The CEWS is distributed by deeming an eligible employer that qualifies for a subsidy to have overpaid income taxes equal to the amount of the subsidy it is entitled to under the program. The Minister may refund such deemed overpayments at any time in the taxation year in which an overpayment is deemed to have arisen.

Tax Treatment of the Subsidy

The CEWS will be treated as government assistance for purposes of the Act and thus included in an eligible employer’s income for the taxation year. The employer should then be able to offset the inclusion with a corresponding deduction in respect of remuneration paid to its employees. However, the treatment of the CEWS as government assistance may have unintended consequences for certain taxpayers, such as those who earn investment tax credits in respect of scientific research and experimental development expenditures.

Anti-Abuse Rules

The initial CEWS legislation contained a broad anti-avoidance rule that deems an employer not to be eligible for the CEWS where, in general terms, it artificially reduced its revenue in order to qualify for the CEWS. The most recent legislative amendments have expanded the scope of this anti-avoidance rule to apply where an employer artificially reduces its revenue to increase the amount of a subsidy it would be entitled to under the program.

If this anti-avoidance rule applies, the employer will be required to repay any subsidy it received and will automatically be liable for a penalty equal to 25% of the subsidy it claimed under the CEWS. In addition, the general gross negligence penalty under the Act has been extended to apply to amounts received under the CEWS. Thus, an additional penalty equal to 50% of any subsidy received under the CEWS may be imposed on an employer that can be demonstrated to have knowingly, or under circumstances amounting to gross negligence, applied for the CEWS using false or misleading information.

Public Disclosure of an Applicant’s Identity

Although taxpayer information collected by the government is typically considered to be confidential, this is not the case with respect to the identity of taxpayers that apply for the CEWS. The CEWS legislation provides that the government is entitled, but not obligated, to publicize, in any manner considered appropriate, the name of any person or partnership that applies for relief under the CEWS. Presumably, the government intended this provision to reduce the risk of fraudulent use of the program. However, it could give rise to privacy concerns, especially with respect to individual applicants, and to reputational risk for applicants.

The CRA’s administrative guidance states that it intends to publish a list or registry of CEWS applicants. Such a registry has not been published to date.

Applying for the Subsidy

To accommodate the latest extension of the CEWS program, the application deadline has been extended from September 30, 2020, to January 31, 2021. A separate application must be filed for each qualifying period, even if the employer automatically qualifies for the CEWS in the period in question by virtue of qualifying for the program in the immediately preceding qualifying period.

CEWS applications can be filed through an employer’s CRA My Business Account portal or using an online application form. An individual who has principal responsibility for the financial activities of the employer must attest that the application is complete and accurate in all material respects.

For further details, see the CRA’s dedicated CEWS question-and-answer page.

Appeals of Subsidy Determinations

The most recent legislative amendments provide that the Minister may, at any time, determine the amount of a subsidy received by an employer under the CEWS and send a notice of determination. Thus, the existing appeal process applicable to notices of determination, such as those used for loss determinations, should be available to taxpayers that wish to dispute the amount of subsidy set out in the notice. Taxpayers wishing to challenge such a determination should be mindful of the deadline for filing a notice of objection, which is generally 90 days from the date the notice of determination is mailed.

Key Contact

Related

Federal Court of Appeal Confirms CRA Can Collect Arrears Interest Despite Absence of a Tax Debt

Dec. 04, 2024 - The Federal Court of Appeal (FCA) recently dismissed the Bank of Nova Scotia’s (BNS) appeal and upheld the Canada Revenue Agency’s (CRA) practice of charging arrears interest on a non-existent tax debt where audit adjustments increase taxable income that is offset by the carryback of a loss...